Grain crisis: why Ukraine's closest neighbors hit agricultural sector

Whatever the arguments of Poland, Slovakia, Hungary, and Bulgaria regarding the ban on food exports from Ukraine, they are currently playing on Russia's side

For years, Russia has been used to using gas and oil as tools to blackmail its European partners. However, after the full-scale invasion of Ukraine, which is one of the largest food producers in the world, the first thing they did was to block the export of Ukrainian grain through the Black Sea. As a result, the UN and the G7 ambassadors started talking about the threat to global food security without the resumption of exports from Ukraine. Subsequently, it was the UN that became one of the parties to the so-called grain agreement, which allowed the resumption of Ukrainian grain exports. So how did it happen that Ukrainian grain suddenly became undesirable on the European market, and other products such as honey, sugar, and even wine were banned along with it?

Why is it so important for Russia to block Ukrainian exports?

For a long time, ferrous metals accounted for the lion's share of Ukraine's exports. However, in recent years, the share of grains and oilseeds has been steadily increasing. According to the State Statistics Service, in 2021, Ukraine exported ferrous metals worth USD 13.95 billion, and grains worth USD 12.3 billion. This means that our foreign exchange earnings and the hryvnia exchange rate were largely dependent on grain.

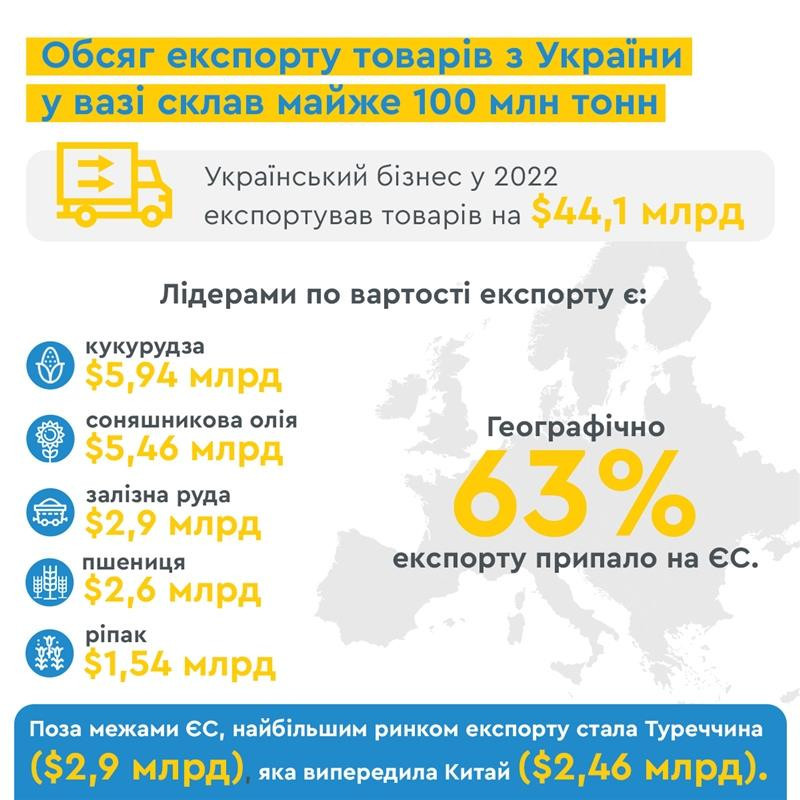

Moreover, because of the war, iron ore exports fell by 45.9% in volume and 57.8% in value to USD 2.9 billion (according to the Ministry of Economy). Food exports also declined, but not as dramatically. In particular, corn was exported for USD 5.94 billion, oil for USD 5.46 billion, and wheat for USD 2.6 billion. At the same time, wheat exports fell the most - by more than 44%.

The second reason why Russia is trying to "knock Ukraine out" of grain exports is direct competition. Due to supply disruptions, Ukraine is losing its established markets in Asia and Africa, and Russia is successfully occupying them. Among other things, it trades in stolen Ukrainian grain. Sea shipments of wheat in January and February totaled 6.1 million tons, up about 90% from a year earlier, according to Logistic OS, Bloomberg reports.

Therefore, it is quite expected that Russia will continue to block the grain corridor (as of April 17-18, 50 ships carrying Ukrainian grain were blocked in the Black Sea) and will try to create obstacles to Ukrainian exports in other ways.

Why did Eastern European farmers start protesting?

Ukraine used to export most of its agricultural products by sea to Asia and Africa. However, due to the blocked ports, exports were impossible, and a shortage occurred on the global market, causing prices to rise. Around April last year, European supermarkets faced a shortage of sunflower oil, flour prices went up, and then prices for milk and meat started to rise. For many Europeans, it was a surprise that the distant war in Ukraine could affect the prices of their usual products, as the raw materials for them came from Ukraine.

In May last year, the European Union abolished import duties on Ukrainian food. Wheat, sunflower, and corn, which had previously been shipped by sea, began to be transported by land. First of all, to Romania, and from there to the Black Sea ports, as well as through Poland to the Baltic ports.

“When Ukrainian grain went through European countries, the supply on the European market increased. Indeed, this is the reason why grain prices in Romania and Poland have fallen. It is difficult to analyze what had a greater impact - the global factor of lower prices or Ukrainian exports. Polish farmers linked it to the situation in Ukraine and demanded that Ukraine stop exporting. Because our grain, despite transit, partially ended up on their market,” Tetiana Hetman, director of the agro-industrial development department at the Lviv Regional State Administration, said.

Another problem was that the infrastructure was not ready to transport and store large quantities of grain. As a result, there were days-long queues at ports for loading, which local entrepreneurs also did not like.

Protest of Polish farmers in February 2023

Unlike in Ukraine, where grain is mostly grown by large agricultural holdings, in Poland it is mostly small local enterprises. But there are a lot of them. Therefore, they are an influential group of voters. And they are dissatisfied with the government's policy of not being able to protect their interests. And given that elections are due in Poland in the fall, the ruling Law and Justice party had to respond to their demands.

Fraudulent scheme with the sale of technical grain for flour

The situation was further fueled by a scandal involving technical grain from Ukraine, which was allegedly sold on the Polish market as food to the country's largest flour producers. According to Rzeczpospolita, the fraudsters were supposed to receive a material benefit of PLN 1.5 million.

The case is currently under investigation in Poland, so it is not yet known whether it was a Ukrainian company that substituted the documents or one of the Polish intermediaries. However, this scandal has cast a shadow over all Ukrainian grain, saying that it is of poor quality and may be contaminated with fungi and pesticides because it is not tested. Meanwhile, the Ukrainian government ignored the problem. Although they could have announced a parallel investigation to at least pretend that we are concerned about the quality of the grain supplied to European consumers.

Obviously, the Ukrainian government was so convinced of Poland's 100% support that it did not take into account that Poles, not Ukrainians, will vote in the Polish elections, so it is their demands that will be taken into account by the authorities. Finally, despite the incredible assistance from the Polish authorities, we should not forget that there are pro-Russian forces there, although not as obvious as in Hungary.

Last year, Poland increased imports of agricultural products from Russia

As for the decision to ban exports and transit (transit is to resume on April 21), it came as a shock not only to Ukraine and the European Commission, but also to Polish companies. After all, the embargo applies not only to the grain that caused the protests, but also to other goods that Poland cannot cover with its own production.

“Already at the weekend, one Polish trader faced the consequences of the introduced rules. His containers with honey, which were heading to the port of Gdansk and then to the United States, were blocked at the Polish-Ukrainian border. Another example of an incomprehensible decision is the inclusion of Ukrainian wine in the list of banned products, the share of which remains negligible on the Polish market,” the Polish-Ukrainian Chamber of Commerce said in a statement.

At the same time, in the first five months of 2022, the value of agri-food imports from the Russian Federation to Poland amounted to EUR 178 million. This is 48% more than in the previous year. In general, last year, exports of agri-food products from Russia to Poland increased by 37.5% - from EUR 307.3 million in 2021 to EUR 422.5 million in 2022.

“As a logistics hub for Ukraine, Poland has become its largest window to the world after the blockade of the Black Sea ports. This means that it is necessary to optimize customs, veterinary and phytosanitary control measures and determine solidarity terms of trade, rather than imposing bans on Ukrainian goods that can be imported from Russia at the same time,” Dariusz Szymczycha, the Vice President of the Polish-Ukrainian Chamber of Commerce, said.

"An example of how solidarity with Ukraine in Europe can weaken"

The German Die Welt publication writes that the Polish ban is a typical example of the dynamics of Polish politics on the eve of the fall parliamentary elections in Poland.

“This case is an example of how solidarity with Ukraine in Europe can quickly weaken if the costs for a member state are too high,” Die Welt wrote.

After the Polish embargo on Ukrainian food, similar decisions were made by Hungary, Slovakia, and Bulgaria. In fact, currently, the only countries to which Ukrainian farmers can still sell their products, and not just transport them through the territory, are Romania and Moldova. However, Agriculture Minister Petre Daea asked the Ukrainian side to quickly find ways to limit the export of grains and oilseeds (sunflower, rapeseed) to Romania, given the difficulties faced by Romanian farmers.

What Ukraine can do in this situation

The decisions of neighboring countries, which are also EU members, violate European law, and the European Commission has already condemned the individual decisions of Poland and Hungary. However, there is little hope that the EU will force Ukraine to lift its grain import restrictions. According to the Financial Times, Brussels is preparing to restrict imports from Ukraine to five EU member states. In other words, they will actually try to legalize the decisions already made.

Meanwhile, some agricultural enterprises in Ukraine are demanding that the government impose restrictions on imports of goods from Poland. In particular. The Union of Dairy Enterprises of Ukraine (UDEP) has asked the Cabinet of Ministers to protect the domestic dairy industry and apply mirror measures to Polish dairy products, in particular, to ban their imports for the period of the ban on exports of Ukrainian dairy products to Poland. However, it is unlikely that such mutual restrictions will help resolve the agricultural crisis, rather the opposite.

According to agricultural market analyst Andriy Yarmak, the only thing left for the Ukrainian government is to negotiate and find compromises. Moreover, Poland's decision to temporarily ban imports of agricultural products from Ukraine will have a negative impact on their livestock industry due to rising feed prices, so they will also put pressure on the Polish government.

In addition, the Ukrainian side should ensure that Ukrainian traders do not violate transit rules during the negotiations. That is, if the goods are supposed to transit through Poland or Romania to the nearest port, they should not enter the domestic market of these countries.

- News